Recap: Global shares rose yesterday amid optimism fed by sturdy US financial and earnings reviews, whereas Covid restrictions receded in some international locations. The upturn capped a volatile week in which worries about inflation and an early US interest-rate hike pushed the greenback close to a three-month low, the cryptocurrency market tanked whereas gold and silver shone as safe-haven property.

The SET index moved in a spread of 1,529.69 and 1,570.37 factors this week earlier than closing yesterday at 1,552.44, up by 0.19% from the earlier week, in day by day turnover averaging 90.25 billion baht.

Retail buyers have been internet patrons of 4.95 billion baht, institutional buyers purchased 1.73 billion and brokerage companies bought 1.49 billion baht price of shares. Foreign buyers have been internet sellers of 8.18 billion baht.

Newsmakers: The US financial restoration confirmed indicators of hitting some turbulence as consumers curbed their spending final month and manufacturing slowed on account of provide bottlenecks.

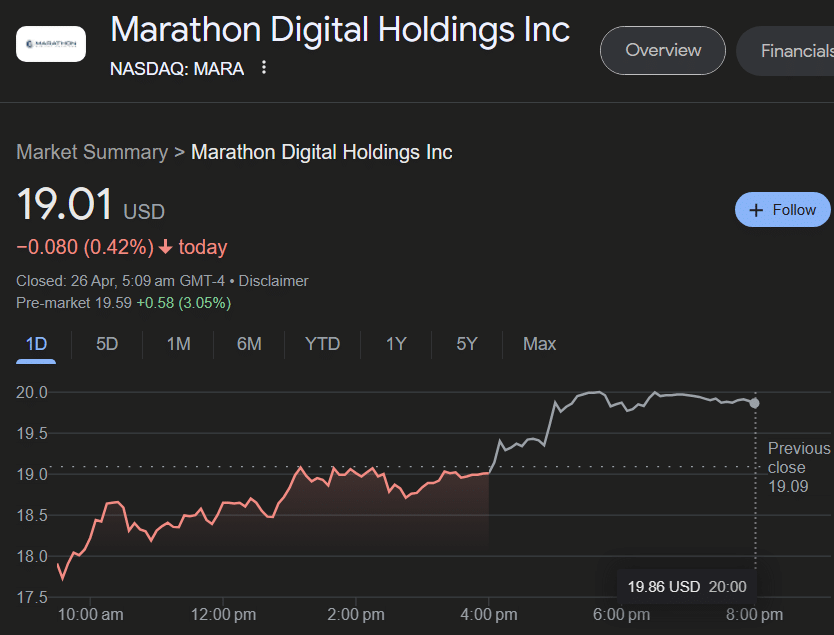

- Bitcoin plunged under $39,000 for the primary time in greater than three months on Wednesday after China mentioned cryptocurrencies wouldn’t be allowed in transactions. Beijing warned buyers in opposition to speculative buying and selling in tokens, though China powers many of the world’s crypto mining.

- The US Treasury Department on Thursday known as for a tax on transfers of cryptocurrencies between companies because it appears to lift income to pay for $1.6 trillion in social spending.

- Gold costs touched a four-month excessive of $1,890 an oz, as rising inflation expectations and the Fed’s pledge to maintain rates of interest low for longer revive curiosity in the metallic.

- Steel costs are at file highs in the US amid a broader scramble for commodities that additionally embody lumber and aluminium, as companies grapple with scant inventories, empty provide chains and lengthy waits for uncooked supplies.

- China subsequent month will begin taxing imports of “soiled fuels” used to make profitable however lower-quality merchandise with excessive emissions, citing air pollution considerations.

- The Japanese authorities has barred the entry of all overseas travellers who’ve visited Thailand and 6 different international locations in an effort to curb the unfold of the coronavirus.

- A journey bubble between Hong Kong and Singapore on account of open on May 26 has been postponed for a second time, after a spike in circumstances in Singapore.

- Japan is getting ready to approve Moderna and AstraZeneca vaccines, to hurry up an inoculation programme that now covers simply 3.9% of its inhabitants — the slowest charge amongst wealthy international locations.

- Indonesia has briefly halted distribution of 1 batch of AstraZeneca vaccine to run checks for sterility and toxicity following reviews of antagonistic results after immunisations.

- The Thai financial system shrank by 2.6% year-on-year in the primary quarter — an enchancment from a 4.2% contraction in the earlier quarter — however the near-term outlook stays weak.

- In mild of the brand new Covid wave, the National Economic and Social Development Council has minimize its full-year progress forecast to between 1.5% and a couple of.5%, from 2.5% to three.5% predicted in February.

- Even much less optimistic is the Joint Standing Committee on Commerce, Industry and Banking, which now expects GDP progress of simply 0.5% to 2% at finest, regardless of brighter export prospects.

- Thai Airways International collectors on Wednesday authorised its debt rehabilitation plan, paving the best way for fee extension and unpaid curiosity waiver on not less than 170 billion baht in debt. It additionally calls for 50 billion in new capital, however the authorities is cool to serving to the provider entry recent money.

- The Thai monetary system has change into extra weak on account of adverse shocks from the newest coronavirus outbreak and vital dangers to the financial system stay, minutes of the central financial institution’s final assembly confirmed on Wednesday.

- The Revenue Department is anxious that company revenue tax income in the 2021 fiscal 12 months will miss its goal. In the primary six months to March 31, company tax totalled 735 billion baht, 9.4% under the goal and down 8.7% from than the identical interval in fiscal 2020.

- The Bank of Thailand says it’s involved with the anticipated increased variety of non-performing loans of tourism-related companies in the second quarter.

- The Federation of Thai Industries (FTI) is bringing again its “Faster Payment” scheme to induce massive firms to hurry up debt repayments in a recent try to assist their buying and selling companions — largely small and medium-sized enterprises (SMEs) — clear up liquidity issues.

- Employer and worker contributions to the Social Security Fund (SSF) can be halved to 2.5% between June and August to assist these struggling financially due to the pandemic.

- Despite Covid outbreaks, Thailand’s recent fruit export prospects stay promising, notably in China, Vietnam and Hong Kong. The International Trade Promotion Department expects fruit shipments to develop 17% this 12 months to 122 billion baht.

- Domestic automotive gross sales surged 93% in April from a 12 months earlier to 58,132 automobiles, coming off a really low base final 12 months when the nation was in a full lockdown, the Federation of Thai Industries mentioned.

- The authorities’s electrical car (EV) promotion coverage and pandemic-induced considerations a couple of degraded atmosphere are anticipated to assist Sharge Management Co make an exponential leap in its EV charger gross sales to twenty,000 from 250 models inside 5 years.

Coming up: New Zealand will launch first-quarter retail gross sales on Monday. Thailand will launch April commerce knowledge on Tuesday, Germany will launch first-quarter GDP and the US will launch April new residence gross sales and May shopper confidence.

- The SET can be closed on Wednesday for the Visakha Bucha vacation. The US on Wednesday will replace crude oil stock knowledge, and New Zealand will announce an rate of interest determination. On Thursday, China will launch April industrial income and Germany will launch the June shopper sentiment outlook. The similar day, the US will launch first-quarter GDP knowledge, April sturdy items orders and pending residence gross sales.

- Japan will launch May inflation knowledge and unemployment on Friday and the US will launch April producer costs and private spending knowledge. The similar day, the US will announce April retail inventories and May shopper sentiment.

Stocks to look at: Maybank Kim Eng Securities recommends shares of companies with prospects of fine efficiency in the second quarter akin to ASK, BCH, MTC, IVL and WICE.

Asia Plus Securities (ASPS) recommends growing funding in shares anticipated to profit from the lifting of Covid curbs in cities, akin to export-focused companies and insurers, as some funds have began to stream into these teams of shares whose costs stay low because of the impression from the pandemic. In addition, they’re more likely to recover extra clearly as soon as the vaccine roll-out gathers momentum. The brokerage’s picks from the group are STEC, MTC, MAJOR, BDMS, MINT, SAT and BLA.

Technical view: DBS Vickers Securities sees assist at 1,520 factors and resistance at 1,570. Capital Nomura Securities sees assist at 1,529 and resistance at 1,570.